credit theft(carding):

Carding fraud has emerged as a significant threat in the realm of online transactions. This article provides a detailed overview of carding, the tools commonly used by fraudsters, the methods they employ, and steps you can take to protect yourself.

- What is Carding?

Carding is a type of fraud where stolen credit card information is used to make unauthorized purchases. This process typically involves using the stolen card data to buy goods or services, often on websites that lack robust security measures. Carders may also test stolen card information by making small purchases to verify the card’s validity before using it for larger transactions.

- Elements of Carding Fraud

- Card Number: The 16-digit number on the front of the credit card, essential for processing transactions.

Exp Date: The date when the card expires, usually found on the front of the card. Required for validating the card during a transaction.

CVV/CVC: The three-digit (or four-digit) security code on the back (or front) of the card, necessary for online purchases.

Billing Address: The address associated with the cardholder, used for verification during transactions.

Cardholder Name: The name of the individual to whom the card is issued, often required for online orders.

Issuer Bank: The name of the bank that issued the card, sometimes needed for processing transactions or customer service inquiries.

- Tools Used by Carders

- VPN (Virtual Private Network):

- Carders use VPNs to mask their IP addresses, making it harder for authorities to trace their online activities back to their physical location. - SOCKS Proxies:

- SOCKS proxies allow carders to route their internet traffic through a server, further obscuring their identity and location. This is useful for bypassing geolocation restrictions on certain websites. - Prepaid Cards:

- Fraudsters often use prepaid debit or credit cards purchased with stolen card information to make online transactions, allowing them to avoid direct links to their identity. - Stolen Account Credentials:

- Carders often acquire usernames and passwords for online retailers or payment platforms to make purchases without needing to input card details. - Carding Forums.

- Online communities where carders share tools, tips, and stolen card information. These forums facilitate the exchange of methods and data among fraudsters. - .Carding Bots:

- Automated scripts that can test large volumes of stolen credit card information against various merchant sites to find valid cards.

- Common Methods of Carding Fraud

- Testing Cards:

- Carders make small purchases to verify stolen card information before using it for larger transactions. - Account Takeover:

- Fraudsters gain access to an individual’s or business’s bank account or retailer account by stealing login credentials, often through phishing or data breaches. - Data Breaches:

- Fraudsters acquire card information from data breaches involving online retailers or financial institutions, then use this data for carding. - Skimming:

- Devices placed on ATMs or point-of-sale terminals capture card information when customers swipe their cards. - Phishing:

- Scammers send fake emails or messages to trick individuals into providing their credit card information, often mimicking legitimate sources. - Social Engineering:

- Fraudsters manipulate individuals into revealing their card information through deceptive tactics, including impersonating trusted figures.

- Steps to Prevent Carding Fraud

- Monitor Accounts Regularly:

- Check bank statements and transaction histories for any unauthorized charges. - Use Strong Passwords:

- Create complex passwords and change them regularly, especially for online banking and shopping accounts. - Enable Alerts:

- Set up transaction alerts with your bank or credit card provider to receive notifications of any unusual activity. - Use Virtual or Disposable Cards:

- Some banks offer virtual card numbers for online transactions, adding an extra layer of security. - Educate Yourself on Phishing:

- Be wary of unsolicited emails or messages asking for personal or financial information. Always verify the source before clicking links. - Implement Security Software:

- Use antivirus software and firewalls to protect against malware and online threats. - Shop on Secure Websites:

- Ensure the websites you shop on use HTTPS and have secure payment gateways.

- What to Do If You Become a Victim:

- Contact Your Bank Immediately:

- Report the fraudulent activity and ask them to freeze or monitor your accounts. - File a Report:

- Report the fraud to local law enforcement and the Federal Trade Commission (FTC) or equivalent authorities in your country. - Monitor Your Credit Report:

- Check your credit report for any unauthorized accounts or inquiries. - Change Passwords:

- Change passwords for your financial and online accounts linked to your card.

ACH & Wire fraud:

Wire transfer and ACH transfer fraud are serious threats that can lead to significant financial losses. Understanding the tactics used by fraudsters and implementing protective measures can help safeguard your finances. Stay vigilant, educate yourself and your team, and always verify before initiating any transfers. Remember, it’s better to be cautious than to face the consequences of fraud.

As electronic payment methods like wire transfers and Automated Clearing House (ACH) transfers become increasingly common, the risk of fraud associated with these transactions has also risen. This article provides a comprehensive breakdown of both wire transfer and ACH transfer fraud, the methods used by fraudsters, and steps to protect yourself.

What is Wire Transfer Fraud?

Wire transfer fraud involves unauthorized transfers of funds from an individual's or business's bank account. Fraudsters typically employ deceitful tactics, such as phishing or social engineering, to trick victims into providing sensitive information or approving transactions.

What is ACH Transfer Fraud?

ACH transfer fraud refers to unauthorized electronic transfers of funds through the ACH network. This type of fraud occurs when a fraudster gains access to a victim’s bank account information and uses it to initiate unauthorized transactions.

- Elements of Wire Transfer and ACH Transfer Fraud:

1. Target: Victims can include individuals, businesses, or organizations.

3. Motivation: Financial gain is the primary motive, exploiting the victim’s trust or urgency.

4. Execution: Transfers are usually completed quickly, often before the victim realizes fraud has occurred.

5. Required Information:

- Account Numbers: Necessary for initiating transfers; fraudsters need both the victim's and the recipient's account numbers.

- Fullz: A complete set of personal information about an individual, including name, address, Social Security number, and other identifying details. Fullz are used to impersonate victims and initiate transfers.

- Routing Numbers: Required to identify the bank for transfers, allowing fraudsters to direct funds to their accounts.

- Login Credentials: Usernames and passwords for online banking, enabling access to accounts and facilitating unauthorized transactions.

- Security Questions and Answers: Often used for account recovery; fraudsters can bypass security measures if they possess this information.

- Common Methods of Wire Transfer and ACH Transfer Fraud:

1. Phishing Scams:

- Fraudsters send emails or messages pretending to be legitimate institutions (like banks) to steal personal information.

2. Business Email Compromise (BEC):

- Attackers infiltrate a business’s email system to impersonate executives or suppliers, convincing employees to send money to fraudulent accounts

3. Fake Invoices:

- Scammers create and send fake invoices to businesses, requesting payment for services or goods that were never provided.

4. Account Takeover:

- Attackers gain access to an individual’s or business’s bank account by stealing login credentials, often through phishing or data breaches.

5. Romance and Tech Support Scams:

- Victims are manipulated into sending money based on false romantic connections or by fraudsters posing as tech support agents.

- how to to Prevent Wire Transfer and ACH Transfer Fraud:

1. Verify Information:

- Always double-check any requests for transfers. Use trusted channels to confirm the legitimacy of the request.

2. Educate Employees**:

- Conduct regular training on recognizing phishing attempts and other scams, especially in a business environment.

3. Use Two-Factor Authentication:

- Implement two-factor authentication on accounts to add an extra layer of security.

4. Monitor Accounts Regularly:

- Keep an eye on bank statements and accounts for any unauthorized transactions.

5. Secure Sensitive Information:

- Protect personal and financial information, especially when communicating online. Use encrypted channels when possible.

6. Implement Strong IT Security Measures:

- Use firewalls, antivirus software, and keep systems updated to protect against malware and hacking attempts.

7. Limit Access to Sensitive Accounts:

- Restrict access to financial accounts and sensitive information to only those who need it.

8. Be Cautious with Unsolicited Communication:

- Be wary of unsolicited emails or calls asking for sensitive information or urgent money transfers.

- What to Do If You Become a Victim?

If you suspect you’ve fallen victim to either wire transfer or ACH transfer fraud:

1. Contact Your Bank Immediately*:

- Report the incident to your bank and ask them to freeze your accounts if necessary.

2. File a Report*:

- File a report with local law enforcement and the Federal Trade Commission (FTC) or equivalent authorities in your country.

3. Monitor Your Accounts*:

- Keep an eye on your financial accounts for any unusual activity.

4. Change Passwords*:

- Change passwords and secure all online accounts linked to your financial information.

romance scam:

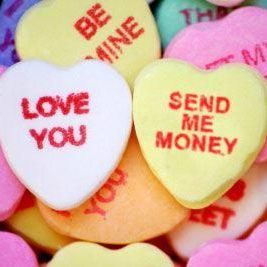

A romance scam is a type of fraud where a scammer creates a fake identity on a dating platform or social media to build a relationship with an unsuspecting victim. The ultimate goal is typically financial gain, often through emotional manipulation. The scammers may exploit the victim's feelings, leading them to send money or provide personal information.

- Key Characteristics of Romance Scams:

- Fake Profiles: Scammers create elaborate profiles using stolen photos and fictitious biographies to establish a believable persona. They often claim to be from another country, adding an element of intrigue and emotional distance.

- Emotional Manipulation: Scammers use psychological tactics to cultivate a sense of urgency or dependency. They may express deep feelings of love or neediness early in the relationship, which can cloud the victim's judgment.

- Financial Requests: After building trust, the scammer will typically request money for various reasons, such as medical emergencies, travel expenses, or business investments. These requests are often framed as temporary and positioned as an opportunity to help.

- 4. **Isolation Techniques**: To maintain control, scammers often encourage their victims to cut off contact with friends and family, claiming that others don’t understand their love. This isolation makes the victim more dependent on the scammer.

- Common Methods Used in Romance Scams:

- Social Engineering Techniques:

-Scammers often employ social engineering techniques to gain the victim's trust. They may Research the Victim: Scammers often gather information from social media profiles to tailor their approach, making their deception more convincing.

-Create Shared Interests: By mirroring the victim’s interests and hobbies, scammers establish a false sense of compatibility, which can lead to deeper emotional connections.

- Phishing Scams:

Once trust is established, scammers may attempt to collect sensitive information through phishing:

- Spoofed Emails: Scammers send emails that appear to be from legitimate sources, requesting personal information or directing the victim to fraudulent websites.

Fake Websites: Scammers may create fake dating sites or financial platforms to steal credentials, exploiting victims' trust.

- Puppy Scams (Advance Fee Scams):

This method involves the scammer creating a false narrative, often involving a pet:

- Claiming a Pet Emergency: The scammer may say they need money for a sick pet or an unexpected expense related to pet care, making the request more emotionally charged.

- Money Laundering Techniques:

Scammers often need to make the stolen money harder to trace. They may:

- Wire Transfers: Scammers prefer wire transfers, which are often irreversible. They may ask victims to send money to an account in a different name or even to another country.

Crypto: Increasingly, scammers are using cryptocurrency, which provides a level of anonymity and can be difficult to trace.

- Fake Online Platforms

Some scammers create entirely fake platforms to perpetuate their schemes such as:

- fake chatroom site: These sites are designed to look legitimate and facilitate connections between scammers and victims. They may even have fake testimonials to appear credible.

- Red Flags:

1. Too Good to Be True: If someone appears perfect or too idealized, it’s worth being skeptical.

2. Inconsistent Stories: Look for discrepancies in what they say or how their stories change over time.

3. Requests for Money: Any solicitation for money, especially from someone you haven't met in person, should raise alarms.

4. Pressure Tactics: If they try to rush you into making decisions or sending money, it’s a significant red flag.

- Prevention and Protection:

1. Research Profiles: Conduct reverse image searches of profile pictures to check if they are stolen. Look for inconsistencies in the person’s stories or background.

2. Stay Skeptical: Maintain a healthy level of skepticism, especially regarding financial matters.

3. Talk to Friends or Family: Discuss your relationship with others who may provide a different perspective.

4. Report Scams: If you suspect a scam, report it to the relevant authorities or the platform where the contact was made.

refunding scam:

Refunding scams are a deceptive form of fraud where victims are manipulated into believing they are entitled to a refund or compensation for a variety of reasons. These scams can occur through various channels, including email, phone calls, and online platforms. As a cyber security graduate, this article will provide a detailed breakdown of refunding scams, the methods employed by scammers, and how individuals can protect themselves.

A refunding scam typically involves a scammer convincing a victim that they are due a refund for a product or service they purchased, or that a financial transaction was incorrectly processed. The scammer may pose as a representative of a legitimate company, claiming they need the victim’s personal information or payment details to process the refund.

- the Common refunding Methods

- 1. Phishing Emails

Phishing remains one of the most common methods for executing refunding scams:

- Spoofed Email Addresses: Scammers use email addresses that closely resemble those of legitimate companies. A minor difference in spelling or an altered domain can often go unnoticed by victims.

- Urgent Language: Emails typically use urgent language, urging the victim to act quickly to claim their refund. Phrases like “immediate action required” or “your account will be suspended” are common.

- Links to Fake Websites: These emails often include links to fake websites designed to capture personal information. The sites may mimic the look of legitimate company sites but are set up to steal data.

- 2. Phone Scams

Phone scams are another prevalent method for refunding scams:

- Cold Calling: Scammers may call victims directly, claiming to be from a reputable company. They often have basic information about the victim to lend credibility to their claims.

- Scripts and Training: Many scammers are well-prepared with scripts that include common objections and responses, allowing them to manipulate conversations skillfully.

- Spoofed Caller IDs: Scammers can spoof legitimate phone numbers, making it appear as if the call is coming from a trusted source. This adds another layer of deception.

3.Online Marketplace Scams

With the rise of e-commerce, refunding scams have also infiltrated online marketplaces:

- Fake Sellers: Scammers may set up accounts on platforms like eBay, Craigslist, or Facebook Marketplace, selling goods that do not exist. After receiving payment, they may claim a refund is due for various reasons.

- Dispute Manipulation: Once a transaction is completed, scammers might initiate fake disputes, claiming the item was not received or was defective, leading victims to issue refunds.

4. Tech Support Scams

In tech support scams, the scammer poses as a representative from a well-known tech company:

- Unauthorized Refund Claims: Victims receive a call claiming that they are entitled to a refund for a service they did not request. The scammer then asks for remote access to the victim’s computer to "process" the refund.

- Malware: In some cases, remote access is used to install malware, allowing scammers to access sensitive information or steal funds directly.

Refunding scams are a sophisticated and evolving threat that can lead to significant financial and emotional harm for victims. By understanding the methods employed by scammers and recognizing the red flags, individuals can better protect themselves against these deceptive practices. Awareness, vigilance, and education are key to navigating the complex landscape of online fraud and ensuring a safer digital experience.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.